[Part VI] Healthcare and Health Insurance in the US

This is the 6th post in a series of articles about my experience as a software engineer from Australia living in the US for 6 years. You may want to start from Part I to understand other aspects of the move.

In this post I'll cover Healthcare and Health Insurance - how much to pay and what to expect.

Be warned - Healthcare in the US is notoriously bad when compared to most developed nations who have a public healthcare system (yay Australia!).

The Good: Quality of Healthcare

Let's start with what's good about the US system, which is that the quality of treatment you receive is really very good.

We had the following healthcare experiences in the US:

Both our daughters were born in a Californian hospital, along with the relevant pre and post-natal checkups.

I was admitted to an emergency department in another Californian hospital for an Achilles rupture, followed by the subsequent surgery and a year of rehab / physical therapy.

Two visits to emergency departments in Boston and Salt Lake City, for 2 separate cases of food poisoning 🥴

A scheduled wisdom tooth extraction surgery

Routine family doctor and dental checkups

In all cases, the medical staff were professional and knowledgeable, facilities were clean and well-run, and processes for admission and discharge were methodical. I really can not think of any way to improve our experience as far as the medical perspective is concerned.

In my opinion, there are 3 areas where the US system is better than in Australia:

Acute Care is readily available. In Australia we generally only have 2 levels of care ranging from your GP (called your "family doctor" in the US) and emergency departments at a hospital. In the US, there is a third level in between these 2, known as "acute care" which are typically facilities open late or 24/7 for serious but not life-threatening conditions.

Easier access to specialist doctors. For her first 18 months our eldest daughter had regularly scheduled appointments with a pediatrician, who was a specialist doctor for infants and tracked her growth carefully. This was considered standard, even though our child had no special conditions and was "normal". Our youngest daughter turned 1 in Australia, and pediatricians here are only seen with a GP referral and for specific issues, and we didn't seem to have had any scheduled appointments unless she was ill.

Use of technology is more user-friendly. I liked that in the US most appointments could be made via a mobile app, unlike some GPs in Australia still requiring a phone call to make an appointment. We also found that most facilities had user portals where you could download medical summaries, pay bills, etc.

The Terrible: Healthcare Charges

We were fortunate enough to have been covered by good quality health insurance when we were in the US (more on this later).

From what I understand, if we didn't have health insurance, we could still have received any treatment but charged an exorbitant amount. Apparently, medical bills in the US account for 40% of bankruptcies so you better have health insurance 🫨

What's an exorbitant amount?

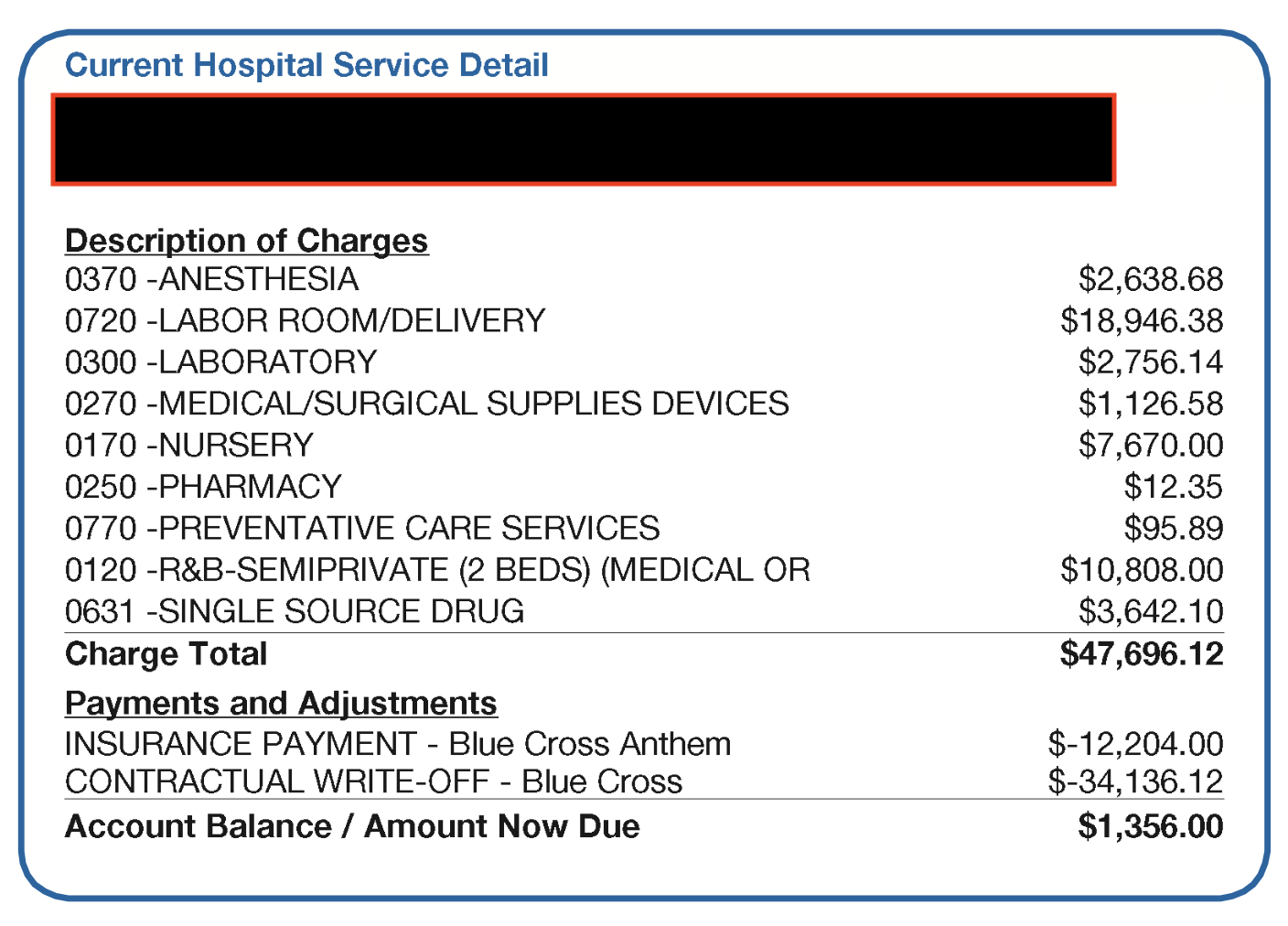

Here's an actual bill from the birth of our youngest daughter in 2021. You can see that the total charge is USD $48,000 for a routine delivery with no complications and an overnight hospital stay.

Then, because we had insurance, huge amounts are "written off" and we ended up paying a more manageable USD $1.3k (not including the cost of insurance, more on this later). It was impossible for us to determine ahead of time how much insurance would pay / be written off despite many conversations with our insurance company, it seemed almost made up.

Apparently if you don't have insurance you would be liable for the full USD $48k but if you explain that you are uninsured the hospital also magically waives some chunk off the bill (but not a lot).

Here's my best guesstimate at the cost for different medical procedures between Australia and the US:

Our childbirth experience (USD $48k total charge, ended up paying USD $1.3k after insurance) vs my sister who delivered her son in New South Wales in 2010 with no health insurance (AUD ~$8k total charge, ended up paying AUD ~$500 in a public hospital paid for by Medicare).

My visit to ER after Achilles rupture (USD $500 total charge, ended up paying USD $350 after insurance) vs my dad's 2 week hospital stay in Melbourne (no charge, fully paid for by Medicare).

Surgery to repair my Achilles (not sure what the total charge was, but I ended up paying ~ USD $6k after insurance). My closest hospital in Melbourne has this surgery for a total charge of AUD $6,800 before any deductions from insurance.

I had a wisdom tooth extraction surgery in the US (not sure what the total charge was, but I ended up paying ~ USD $1.5k after insurance). My closest dental clinic in Melbourne apparently charges AUD $450 before any deductions from insurance.

The Confusing: Health Insurance in the US

As you can see from the previous section, you basically must have health insurance in the US if you don't want to risk bankruptcy. This is a stark difference to Australia, where private health insurance is encouraged but the public health system is robust enough where you may not need it.

Another critical difference is that in the US, your health insurance is very likely tied to your employment.

That is, most employers heavily subsidise your monthly insurance premiums and you have a short period (30 or 60 days) after quitting or being fired where you will become uninsured unless you find a new employer. This is done because most large employers negotiate special hidden rates with the main insurance companies in the US, which are not available to you if you approach the insurers directly.

This is in contrast to Australia, where you can pay for health insurance independently from your job, by just signing up with an insurer.

Here's what some typical costs for insurance look like:

In Australia, you can easily get private health insurance for a family of 4 for AUD $150 - $500 per month without any employer subsidies. You'll be covered for a wide range of treatments, and subject to an "excess" of AUD $750 per hospital admission up to a maximum of AUD $1,500 per year for the whole family. If you're lucky enough to have an employer subsidy, you might end up paying only AUD $100 - $200 a month.

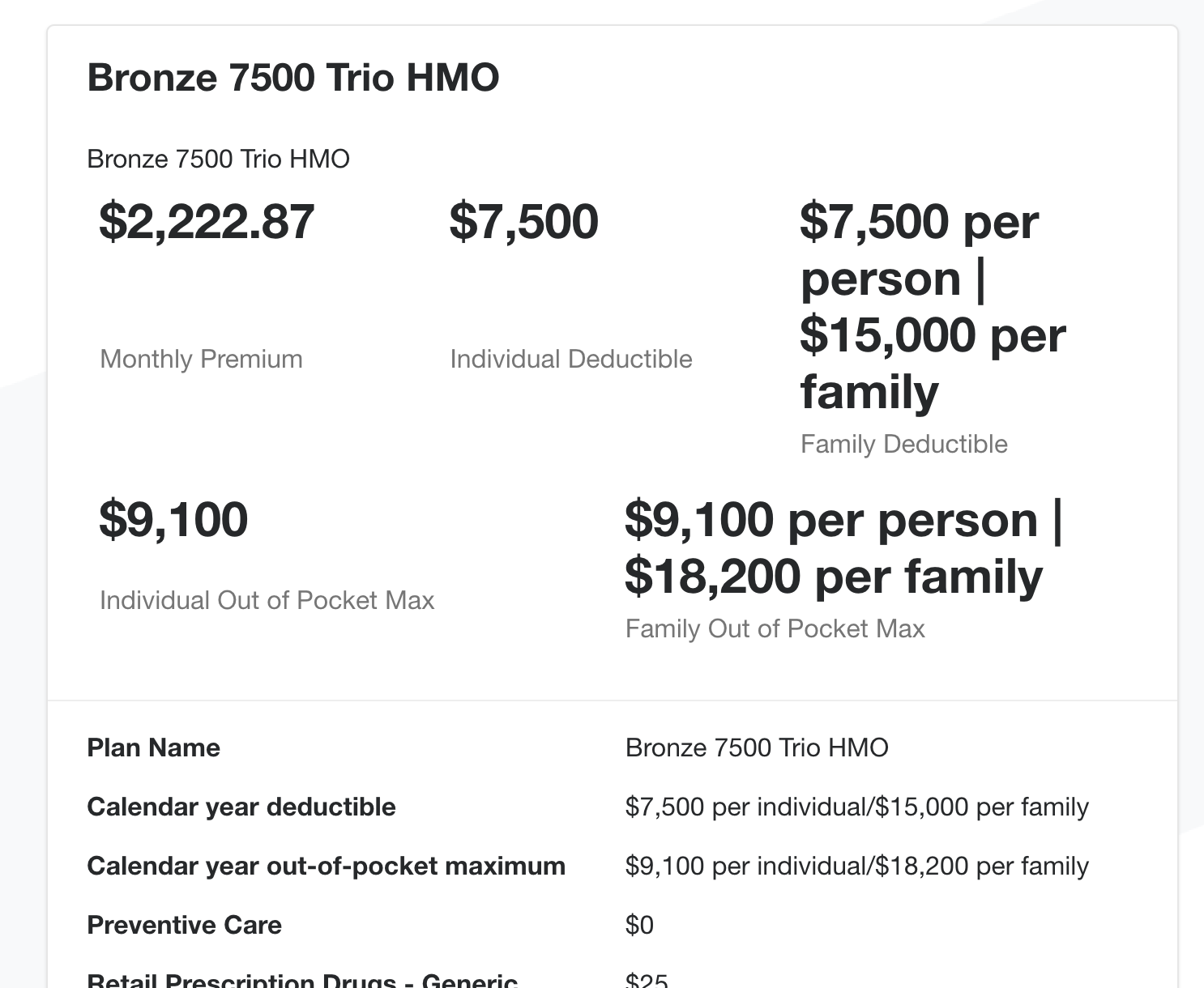

In the US without an employer subsidy, the cheapest plan in my zipcode in the Bay Area was USD $2.2k per month for a family of 4. This doesn't even cover the first USD $15,000 in charges per year, which is what's known as the deductible (the amount you must spend before insurance even starts to pay for you).

In the US with an employer subsidy, we were paying USD $200 per month for a family of 4 and my employer was paying USD $600 per month. We still had a deductible of USD $2,000 before insurance starts to subsidise any costs 😧

To clarify, here is what health insurance actually costs in the US:

Every month you and your employer pay USD $200 - $1,000 in insurance premiums.

You must spend at least USD $2 - $7,000 in medical costs before your insurance even starts to subsidise your costs. This is known as the deductible.

After you reach your deductible, your insurance will start subsidizing 20 - 70% of your medical costs. You will still be paying the difference! This is known as the copay.

Once your total medical costs reach $9,000 - $20,000 in the year, then insurance covers the rest. This is known as the out of pocket max.

But watch out! All of these are set by calendar year. Meaning your deductible and out of pocket max will reset to zero again at the end of the year, and you start paying your own medical costs up to your deductible once again. And all this while you're paying several hundred dollars in insurance premiums 😠